Surface rights vs mineral rights in Colorado

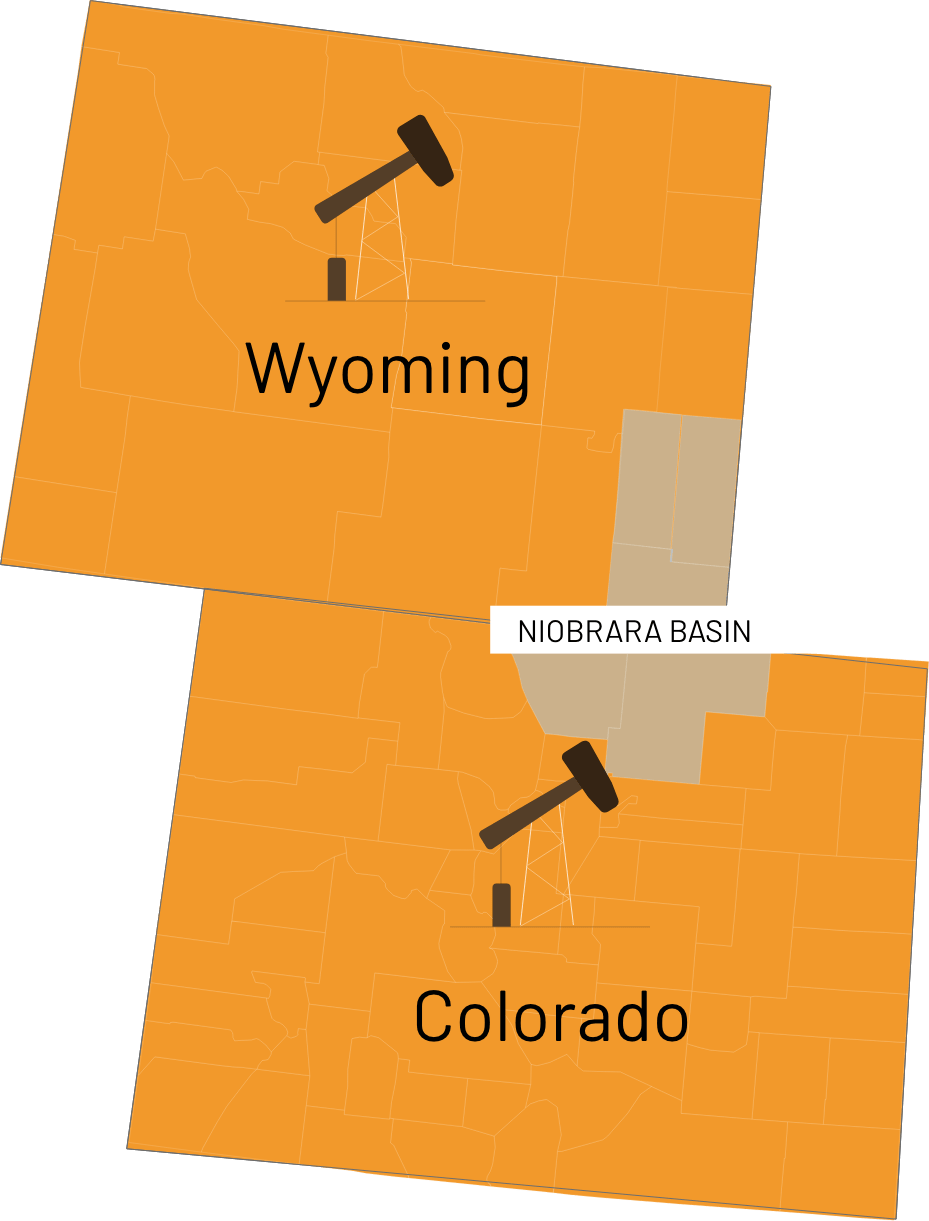

Mineral Rights in Colorado

Mineral rights are those rights that give a person/business the legal right to explore, remove and sell natural resources found beneath the soil surface.

These resources include oil, natural gas, gemstones, coal, precious stones and metals. Asides from these, people also discover elements such as scandium and uranium.

However, ownership of these rights is extremely fragmented as lots of properties usually have one or two ownership rights unrecorded or dozens and hundreds of rights owners can be associated with one small-sized ranch so you have to do proper due diligence on any property before you complete a purchase.

Surface Rights in Colorado

Surface rights as the term indicates are rights to everything on the exterior or upper part of the land. This includes physical edifice such as your house, garage, storage sheds, yards, and barns.

Access to water resources or any other substance not too deep in the soil can be classified under surface rights as subsurface rights.

People who own surface rights are allowed to practice crop farming on the land as well as erect structures the way they like. You can also dig the land to set up your septic system or underground storage tanks.

Severance of Mineral Interests in Colorado

Severance of mineral interests in Colorado is very much possible as it requires the landowner to separate or give up the land ownership rights to someone else.

This severance splits the ownership of mineral rights from ownership of surface rights leaving the owner to do with as they please.

If you as an owner of the land are not sure what the ownership of yours includes, you have to go check the title of the insurance policy or the vesting deeds. There you will find all the references to mineral rights in your land.

The only disadvantage of this is that you may not see the information concerning the present owners of the mineral resources and would require a search outside the real estate records.

The preferred place to conduct your search is the Colorado Oil and Gas Conservation Commission.

They should be open to providing you with the necessary information about the current owners and use of mineral rights. When you want to carry out this research, you have to go with a real estate lawyer with a speciality in such area matters.

Which are the Most Common Minerals in Colorado

The most common mineral in Colorado include: