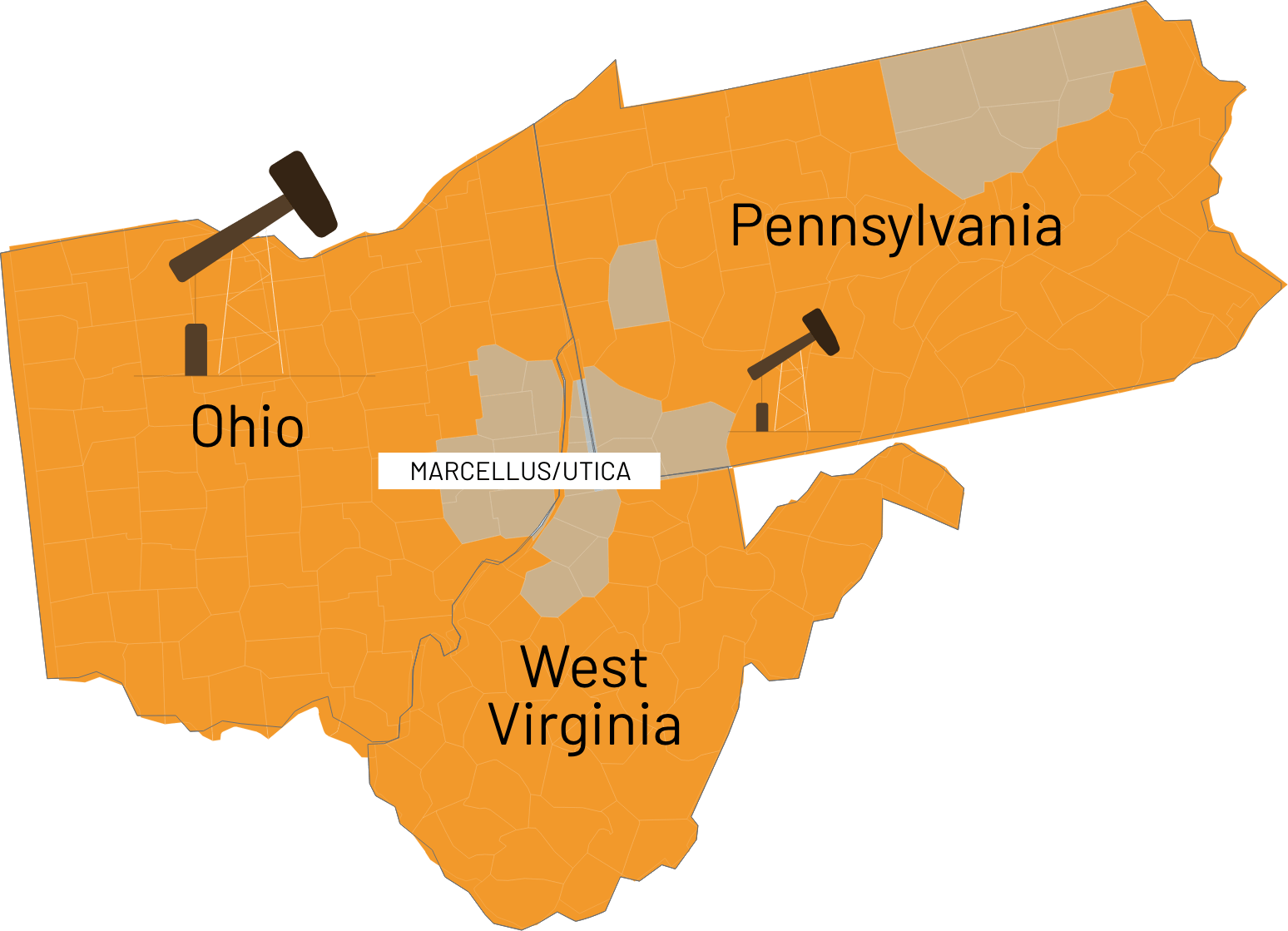

Surface rights vs mineral rights in Ohio

What are Mineral Rights in Ohio?

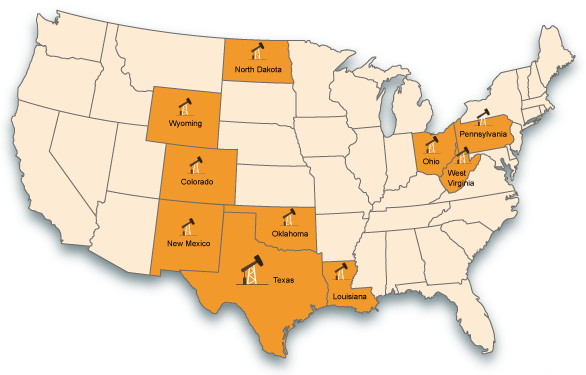

Mineral rights Ohio are normally sold separately from the land where the mineral reside. These rights give holders access to claim the mineral interests on their land. If you own mineral interest on a property, you may have title to them, but if the previous owners have sold or leased these oil and gas rights, you may not be able to sell them.

With these oil and gas rights, owners have access to the minerals in the ground for exploration and production. Nevertheless, mineral rights may be revoked and penalties imposed if mineral owners violate the surface damage agreement specifying what types of activities are permitted by the surface owner.

In addition to leasing and selling mineral rights, holders can bequeath their interest to the next generation as gifts, so that they will continue to exist independently of changes in ownership of the attached property.

Do Mineral Rights Expire in Ohio?

According to an Ohio Supreme Court ruling on a land matter which questioned if oil and gas rights do expire due to lack of production? The court ruled that it’s a use-it-or-lose-it proposition. The Ohio Dormant Mineral Act DMA specifies that if you own mineral rights over someone else’s land, you have 20 years to perform your exploration and production of oil and gas and other mineral or the rights revert to the landowner according to Ohio Supreme court.

Surface Rights in Ohio

Surface rights are the rights that grant surface owners rights to the surface area of a property. This surface area includes any farm, garage or surrounding land in a property. The rights to minerals in the subsurface are not included so except you own both rights, you have no access to what’s underground. Which makes it fantastic for surface rights and mineral rights to coexist in the same property.

However, there would be a conflict between surface and mineral rights holders when either trespass on the contract of their various rights agreement. If no one trespasses, both holders can conduct their business on a property simultaneously.

There could also be a conflict if a mineral rights holder exercises their rights to the mineral underground but causes damage to the surface of a property when extracting their mineral interests. This can lead to conflict especially when the mineral rights holder refuses to fix the damage.