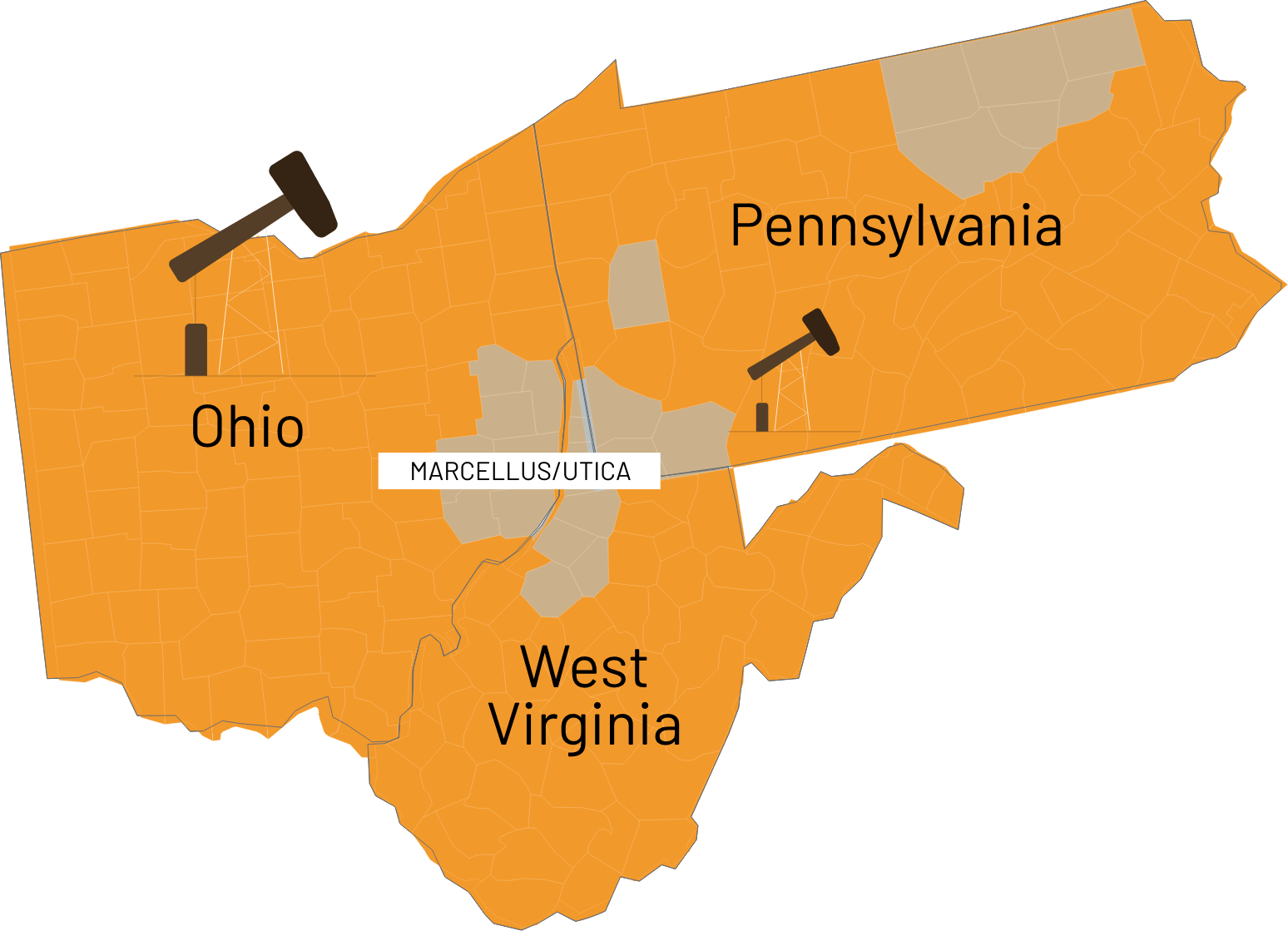

Surface rights vs mineral rights in West Virginia

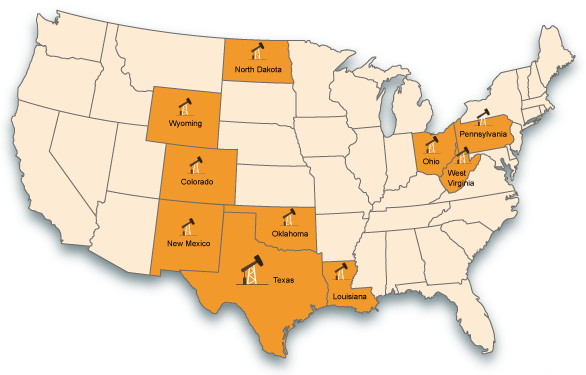

Mineral Rights in West Virginia

Mineral owners in West Virginia don’t purchase the site alone. Like other oil and gas producing states, mineral rights are sold differently from surface rights so you may have to enquire about the land use and mineral rights from a legal point of view before completing any form or contract for purchasing West Virginia mineral real estate in the area, which can be a long process.

West Virginia mineral rights are complicated because they can be split among several owners or within a family, each earning royalties and each being liable to pay tax on their rights. Many who do not pay those taxes lose ownership to the government eventually, even if they didn’t know they were obliged to pay taxes.

Surface rights in West Virginia

Unlike mineral rights, surface rights are those that cover every part of the plot above the ground, and its use. These rights include the structures on the site and permission to use or farm the area or own above-ground resources, including plants, trees, and water on the site.

With this right, you may use the land as you please, and can even dig to a certain depth to install a septic tank. With your surface rights, you can lease or sell the surface rights alone, but nothing concerning the drilling and mining of oil and gas resources beneath. If you know the legal status, then your surface rights can be enough.

When Mineral Rights Conflict with Surface Owner Interests in WV?

In 2021, a judge from the state’s supreme court of appeal declared that mineral owners have no claim to the surface owner’s land to extract minerals. This case and ruling were related to the several conflicts and issues that have happened between the mineral owners and the surface rights owner.

Therefore, when the interest of the mineral owner and that of the surface rights owner clashes due to exploration and extraction activities, the mineral rights owner now has to ask for adequate permission to cover every aspect of their activity that will occupy the above-ground area on the site.