The mineral rights in Wyoming have generated more than 2.2 billion dollars for the American government in form of tax to the local economy and state of Wyoming making it a lucrative business opportunity for the natives.

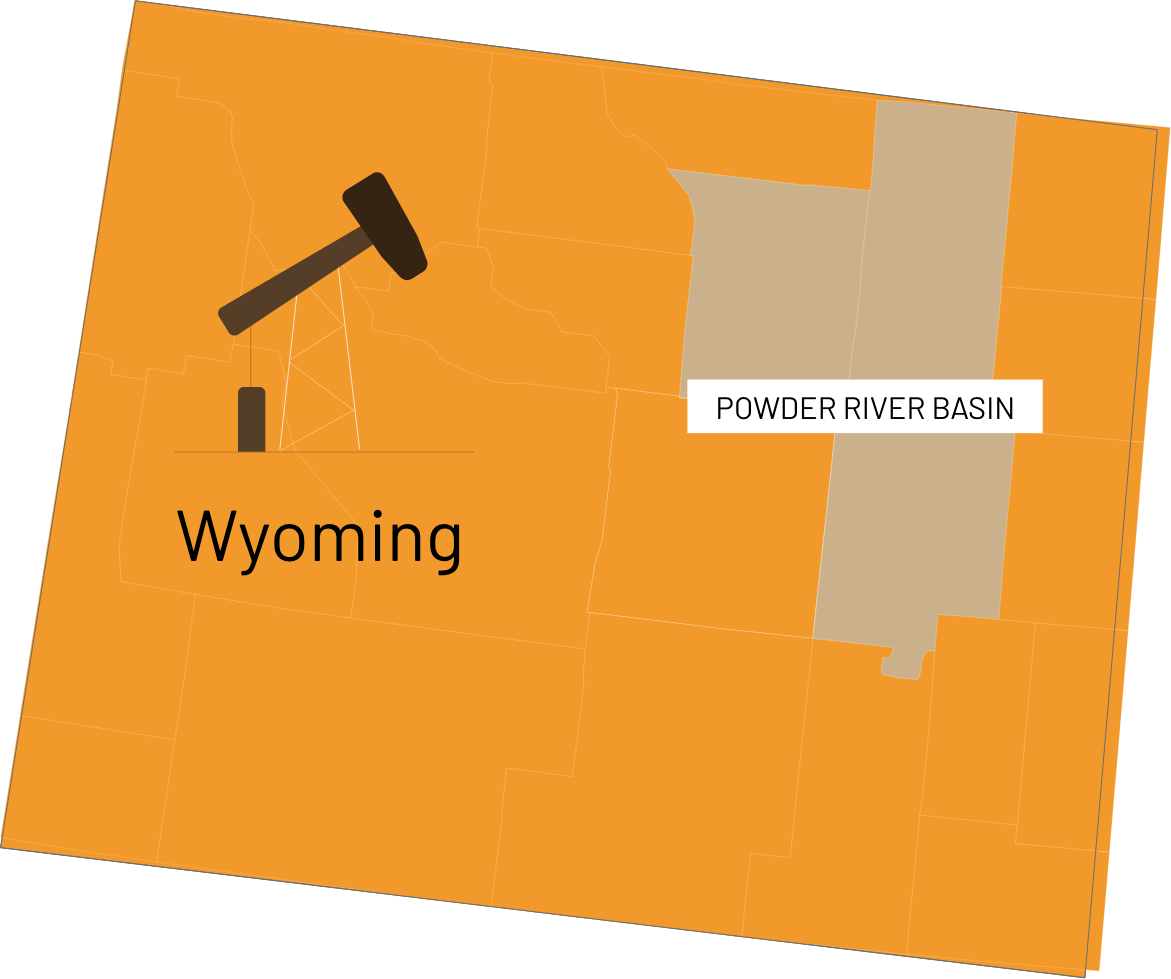

Wyoming has large scale land resources that can provide remarkable income to its owners. The value of mineral rights in Wyoming have tripled over the years due to recent innovations in obtaining minerals such as:

- The horizontal drill bit which enables the well operator to expose more of the wellbore for drilling purposes and,

- The new fracking techniques which disintegrate rocks and allow more for more mineral production

All these recent innovations in technology have improved the process of locating new oil wells and improving mining processes. Investing in mineral rights in Wyoming right now would make major sense due to these recent innovations.