When investors are skittish about the economy, they buy gold. The coronavirus pandemic has brought gold buyers out in droves. By March, some major gold dealers were reporting they had sold out of gold bars. When investors hoarded gold during the 1929 Depression, President Franklin D. Roosevelt made it illegal to possess many forms of gold.

Fortunately, today, gold investors have many options to invest in the precious yellow metal without physically holding gold bars, including gold futures, ETFs, and mutual funds.

The best way to invest in gold depends on your investment objectives and risk profile. This article will learn about why gold is valuable, how the gold price is determined and the 8 best ways to invest in gold, and the ROI.

Share this Image On Your Site

Gold Inflation

When stock and bond values fall, investors buy gold. Gold has long been an inflation hedge that protects purchasing power. The yellow metal became the safe-haven asset because it is the most durable of the precious metals and holds its value well.

The value of fiat currencies (currencies not backed by gold), in contrast, fluctuate with inflation, trade balances, and other factors.

Since gold has a low correlation with the US dollar and other currencies, it an ideal inflation and currency depreciation hedge. When product prices rise, inflation rears its head, and your US dollars’ purchasing power decreases. In contrast, a $1,000 gold bar will rise in value and thus have more purchasing power than a $1,000 US bill.

So it’s no coincidence that the last three major gold price spikes coincided with oil price hikes (1979), the global economic recession (2011), and the coronavirus recession (2020).

In all three cases, gold prices soared as investors placed their money in gold as a safe haven. Gold is a highly liquid asset that can be quickly converted into cash.

Why is gold valuable?

Gold is the heaviest metal on earth and virtually indestructible. All the gold that has been mined throughout history exists in some form today.

These characteristics made gold well-suited for trade among foreign nations before the advent of paper money. Since this rare and only yellow metal does not rust like other metals, governments have backed their currencies with gold since the Middle Ages.

If paper money were to become suddenly worthless, the world could fall back on this precious metal to facilitate trade.

Gold can be melted and remelted and easily cast into different shapes and widths, including gold bullion bars, coins, and fine wires for use in electronics. Because gold is a good conductor of electricity, 10 percent of gold is used in dentistry, heat shields, tech gadgets, and other industrial applications.

How is the price of gold determined?

The price of gold bullion is set twice daily in electronic auctions for physical gold bullion on the London Bullion Market Association (LBMA) market. This price is used as the benchmark in the trade of physical gold bullion and derivatives contracts worldwide.

Gold spot price

The gold spot price is the price for immediate settlement of the gold trade. The price is determined in the gold futures market by the forward futures contract in the month with the most volume.

Gold futures price

The bid price determines the futures contracts’ gold futures price for future months on the leading gold futures exchanges (e.g., COMEX, London OTC market). For monthly futures contracts, traders set prices for settlement dates in the future. Therefore, futures contracts can serve as a price forecasting tool.

In addition to prices set by traders, gold prices are influenced by:

- Supply and demand for gold from the jewelry market and industry

- Central bank buying and selling of gold

- Currency devaluations, which increase the demand for gold

8 Ways to Invest in Gold

Gold Jewelry

Gold jewelry is the main end market for gold, representing over 40 percent of the demand. Although easy to obtain, gold jewelry does not hold its value as well as gold bars or coins. Across the value spectrum, gold jewelry can be melted down for scrap or sell for above its original sale value as a collector’s item.

Jewelry sold as gold scrap

Scrap gold is valued based on weight and purity. When buying gold to invest in, the number of karats is the best way to measure purity. For example:

- 14K = 58.3 percent

- 18K = 75 percent

- 24K = 100 percent

An 18 karat yellow gold Cartier Love Bracelet currently sells for USD 4,050, could get less than a quarter of this value as scrap. While gold was at $1,799 an ounce (July 2020), for example, the melt value of this bracelet (weighing approximately 1 ounce) was around $1,300. However, the dealer could take a discount as high as 40 percent to cover melting and refining costs.

Jewelry sold as a collector’s item

Like luxury brand gold watches, as a collector’s item, pre-owned 18K yellow gold Cartier Love Bracelets retain their value better than gold bracelets from non-luxury brands. They are currently selling for between USD$800–6,000 on eBay. Jewelry from the most expensive jewelry brands—such as Cartier, Van Cleef & Arpels, and Bvlgari—has the highest resale value.

Gold Bars

Gold bars and coins, equal to 25 percent of gold sold, are valued as highly liquid assets that can easily be converted into cash. They should be bought from reputable online dealers. When buying gold bars, ensure you’re purchasing:

- gold-certified as investment-grade (measured by its assay value)

- the stated purity, size, and weight

Like cash, this highly liquid gold asset generally has no value appreciation above the spot price. But when gold bars are in high demand and scarce, dealers can charge a premium. Dealers also mark up the price of the bars to cover their storage and insurance costs. You can negotiate lower prices on larger volume purchases.

Gold Coins

Gold coins are popular collector’s items and one of the best ways to invest in physical gold. Coin dealers commonly trade ancient gold coins alongside modern ones. When valuing a gold coin for collector’s value, consider:

- Metal quality – measured in karats.

- Grading – Gold coins are rated from Fair (F) to Extremely Fine (EF) based on wear, luster, and quality of the die-engraved design. A coin that was never in circulation will be given the highest rating.

- Rarity – Factors that make gold coins rare include the length of the reigning emperor, the size of the mintage, and the number of coins in circulation (e.g., a 1933 Double Eagle gold coin that slipped into circulation, while most of this mintage was scrapped, sold for $7,599,020 in 2002).

- Artistry – The detail, originality, and subject of the artwork on the coin affect its value (e.g., a gold Greek Pantikapaion coin (350–300 BCE) sold for $3.25 million in 2012 based on the fine portraiture of a bearded satyr).

As gold prices spike, even government mints are increasing the price of newly minted gold coins. Dealers are selling out of the most collected gold coin in the world, the American Eagle. The price of a 2019 American Eagle coin has jumped above $1,800.

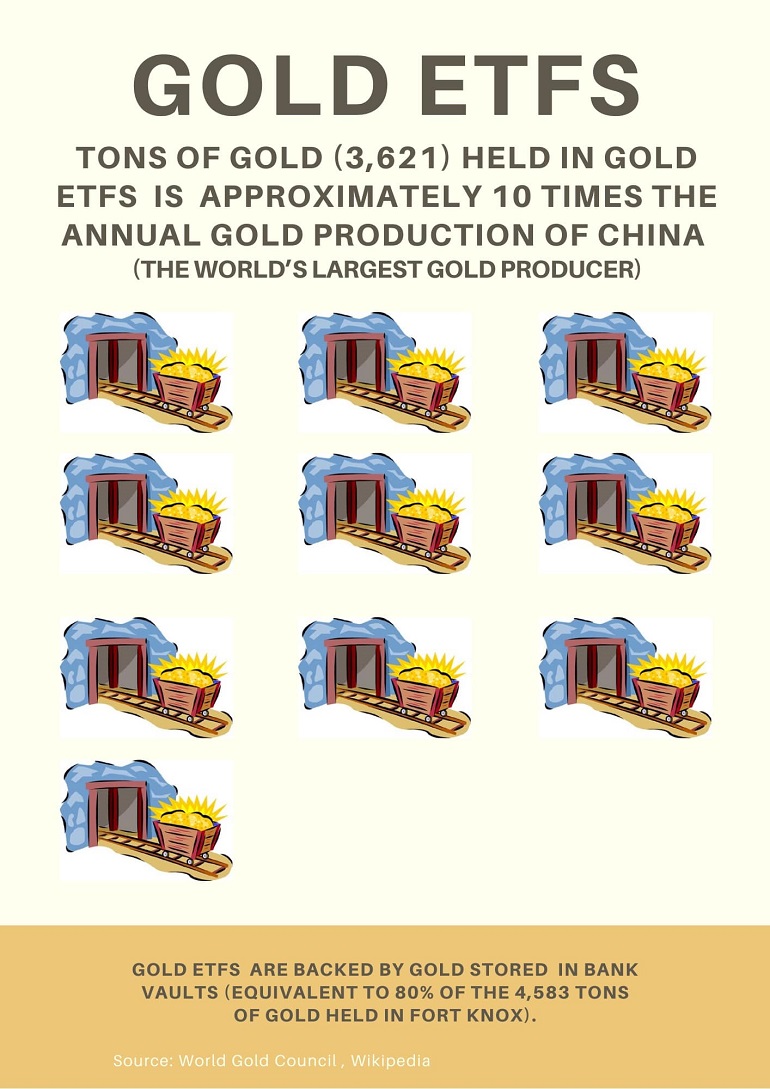

Gold ETFs

Gold exchange-traded funds (ETFs) are popular because they’re convenient, low cost, and highly liquid. In the first half of 2020, investors bought the equivalent of 734 tons of gold (US$39.5 billion) in gold ETFs. That’s 84 tons more than the total gold purchased by the world’s central banks in 2019 (World Gold Council). Gold ETFs are backed by physical gold stored in a bank vault.

Gold ETFs track a transparent gold price index. The average expense ratio for a gold ETF is 0.65 percent. As the fees war escalates, the no-fee gold ETF is making it cheaper to invest in gold. The three main types of gold ETFs are those that track:

- a gold spot price index (the SPDR Gold Trust ETF (GLD) is the largest)

- an index of gold stocks

- commodity futures, such as futures, forwards, and options on gold

Gold Mining Stocks and Mutual Funds

One of the best ways to indirectly invest in gold is through gold mining stocks and mutual funds. Mutual funds invest in a diversified portfolio of gold mining companies. Both actively managed investments provide upside potential beyond the spot price of gold. The gold mining business is a cyclical industry. Gold miners use futures (see below) to hedge changes in production volumes and gold prices.

The mutual fund’s value fluctuates with the value of the gold shares it holds, instead of the price of gold. Active fund managers can manage risks by flexibly rebalancing a portfolio of gold miners. The Fidelity Select Gold Portfolio (FSAFX), for example, holds 80 percent in gold mining stocks but also invests in gold bullion and coins, silver, platinum, diamonds, and other precious metals and minerals.

Major differences from exchange-traded funds are that mutual funds:

- have higher management fees and expense ratios

- are purchased and valued at the end of the trading day, whereas ETFs trade in the intraday stock market like gold shares

- have higher minimum investments

A gold mutual fund could also be comprised of a diversified portfolio of ETFs.

Gold Futures

Gold futures provide a way of investing in gold price movements without having to buy physical gold outright. Over 90 percent of gold trading occurs in the futures markets on the COMEX, the London Bullion OTC market, and the Shanghai Gold Exchange (SGE). Futures are contracts to buy or sell a quantity of gold at a fixed price at a date in the future. A futures contract represents one bar of gold or 100 troy ounces.

Since futures are traded on margin, the investor only needs to pay a percentage of the contract price, typically starting at 3 percent. Leverage can magnify potential gains but also losses.

Lower risk, lower capital mini gold contracts

Mini and e-mini futures have made the futures market more accessible to the average investor. These contracts are a fraction of a standard 100-ounce gold contract. You can invest in gold for as little as $5 with price ticks as low as $0.10 per troy ounce. The mini futures contract sizes are:

- Gold 100 oz

- Micro Gold 50 oz

- Mini Gold 33.2 oz

- e-Mini Gold 10 oz

Since the contract values are smaller, your margin requirements to invest in futures are also less.

Advantages include:

- Do not need to take physical delivery of the precious metal. Most contracts are cash-settled, or a contract can be rolled over into a future period.

- Trading on margin means less capital is required to invest in gold futures.

- Prices are transparently listed on an exchange.

- High liquidity.

Gold Royalty Mineral Interests and Royalty Trusts

If you want to invest in a gold mine directly, you can do so through gold royalty contracts. Gold mining companies sell royalty interests upfront to finance gold exploration and production activity. Your investment provides you with fractional ownership in gold mineral rights. When gold is produced, you will receive your proportional share of the revenue, called royalty streams. Gold royalty contacts can be bought through online mineral exchanges and brokers.

An easier way to stake a claim in gold mining revenues is to invest in royalty and streaming companies. Tax-advantaged royalty trusts allow investors to invest in units of a trust that holds a portfolio of royalty interests in gold mining ventures. As a unitholder, you receive royalty payments in the form of monthly cash distributions. Tax is not payable on these distributions.

Streaming companies provide upfront financing to a gold mining company in exchange for a percentage of future gold production purchased at below-market prices. Companies like Franco Nevada are involved in both the gold trust and streaming market and payout royalty revenues in the form of dividends,

Gold Certificates

Gold certificates are issued for a quantity of gold stored in a bank vault. During the gold standard (abandoned in 1933), when the US dollar value was tied to gold, gold certificates could be used as currency. The creditworthiness of gold certificates is only as good as the company that backs them.

Gold ROI

If you had invested $1,000 in the following markets a decade ago (July 2010–July 2020), you would have earned the following returns on your investment.

- S&P 500 Index $1,880 -188 percent

- Gold $1,441.45 – 44 percent

- Silver $977 – 2.3 percent

- Savings Account $1,219 22 percent (2% APY)

At first glance, the stock market looks more attractive than gold investments. During a market downturn, however, gold shines. From January to June 2020, the value of the S&P 500 stock index fell by -4.7 percent.

Over the same period, gold returned 18.8 percent. That’s why investment advisors recommend allocating at least 5 percent of an investment portfolio to gold to cushion market downturns.

Since gold has a low correlation with stocks and bonds, the yellow metal helps smooth out volatility and deliver more consistent returns.

Conclusion

Whatever your risk tolerance, gold is one of the best ways to diversify your portfolio risk. Gold has a zero or negative beta, essentially making it a risk-free asset like a treasury bond, and is an inflation hedge.

Especially in times of economic crisis, therefore, gold can lower the risk of your investment portfolio. Investment advisors recommend allocating at least 5–10 percent of an investment portfolio to this safe-haven asset to provide a cushion for market downturns.

Leave a Reply